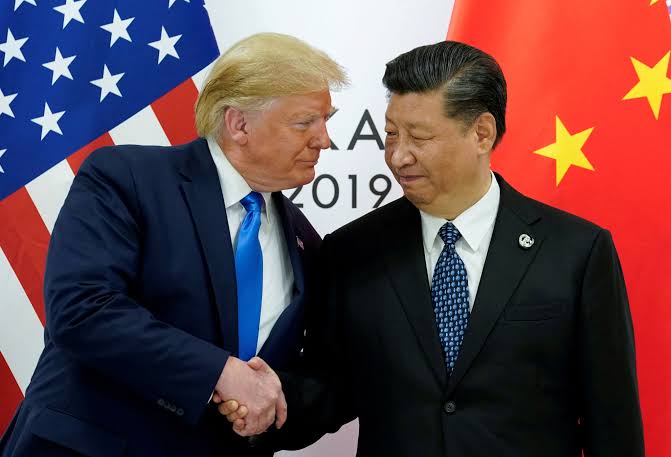

Global markets soared this week after President Trump announced a “total reset” in trade relations between the US and China, signaling a long-awaited break in the tariff war that has weighed on businesses and economies worldwide.

The breakthrough came during weekend talks in Switzerland, where both nations agreed to significantly roll back tariffs that had been piling up since January. The US will reduce tariffs on Chinese goods from 145% to 30%, while China will cut its retaliatory rates from 125% to 10%. Crucially, these reductions are suspended—not eliminated—for a 90-day review period, leaving the door open for renewed tensions if progress stalls.

President Trump struck a conciliatory tone, saying the US is “not looking to hurt China,” noting that economic pressures—including factory closures and labor unrest—had motivated both sides to find common ground. Beijing also agreed to suspend non-tariff barriers and continue discussions.

Markets Welcome the Pause

Investors responded swiftly. The S&P 500 jumped 3.2%, the Dow gained 2.8%, and the Nasdaq surged 4.3%. Retailers like Target and Nike rallied, alongside tech giants such as Amazon, Apple, and Nvidia. European and Asian indexes followed suit, with shipping stocks like Maersk and Hapag-Lloyd seeing double-digit gains.

Short-Term Relief, Long-Term Uncertainty

While the agreement brought short-term relief, many business leaders remain cautious. Chinese exporters, hit hard by the trade slump, say they’re bracing for more volatility. “This isn’t over,” one Shenzhen factory owner told the BBC. Others, like Atlas Ways’ Elaine Li, urged companies to “build a moat” before the next round of tariffs potentially returns.

Industry groups welcomed the move but stressed the need for stability. The National Retail Federation called the deal a “critical first step” ahead of the holiday retail season. The International Chamber of Commerce noted it sends a positive signal—but warned that lingering uncertainty continues to drag on investment and hiring.

As market optimism rises, safe-haven assets like gold fell 3.1%, reflecting renewed investor confidence—for now.

Bottom Line

The US-China trade reset has brought a temporary calm to a turbulent economic landscape. But with tariffs merely paused, not removed, the business world should stay alert. Strategic planning and adaptability will be key as the next chapter of this global economic standoff unfolds.

![[Galaxy Unpacked 2025] A First Look At The Galaxy Z Fold7](https://www.techquery.ng/wp-content/uploads/2025/07/EC5C9262-C536-4F53-BAB3-5B53771FD5F6-183x150.png)